Credit Analysis is an evaluation of the creditworthiness of an individual or business or organization. The objective of the credit analysis is to gauge the ability & intent of the loan applicant to repay the loan. The bank analyzes the Financial Statement, Income Tax Returns, Bank Statements, and other supplementary data of the loan applicant before sanctioning a loan or line of credit. In this blog, we will specifically discuss Credit Analysis through Bank Statement Analysis.

The 5Cs of Credit Analysis

Credit Analysis is governed by the 5Cs: Character, Capacity, Condition, Capital, and Collateral.

Character: The most important characteristic that a lender looks into a borrower is integrity and honesty. The intent of the borrower to pay back the loan. The lender evaluates these qualities based on Credit Score, Education Qualification, Job, Residence Stability, any Criminal Record, etc.

Capacity: After intent comes the ability to repay. The capacity to repay is a function of income and cash flow of the borrower. The financial institutions evaluate the ability to repay using various ratios like Installment to Income Ratio (IIR), Fixed Obligation to Income Ratio (FOIR), Debt Service Coverage Ratio (DSCR), and Residual Income per Person.

Condition: The third important aspect is the Economic Conditions & Business Scenario at the time of giving loans. It can be well understood from the current Covid-19 pandemic. Due to pandemic, there are sectors like Aviation, Travel & Tourism, Hotels & Restaurants, Cinema, and Realty which are the worst hit. On the other hand, Chemicals, Pharma, and IT are least affected. In such conditions, extending a loan to someone working in the worst-hit industries would be riskier than lending to someone working in other sectors. I hope the importance of Condition is well understood.

Capital: The loan amount requested by the borrower and investment the borrower would make. The risk increases with loan ticket size, especially if the loan is unsecured. In case of very high ticket loans, the bank would want to have some collateral as a security and a certain sum of investment coming from the borrower side to mitigate their risk.

Collateral: The asset given as a security against the loan is called collateral. In the case of Home Loans, the home is given as collateral. In the case of Car Loans, the car is kept as collateral and so forth. The collateral can be depreciable (Car), immovable (Home), or volatile (Equities, Gold). Depending on the characteristics of the collateral there is an associated risk weight. E.g. Banks extend 85% to 90% of the home value as loan whereas only 50% of the Equities or Gold value is given as a loan. The ratio of Loan Amount to Asset Value is called Loan-to-Value Ratio (LTV).

What is a Bank Statement Analysis?

Bank Statement Analysis is a detailed analysis of the bank statement of the loan borrower over a period of time. Typically, the bank statement of 6 – 24 months period is analyzed to evaluate the borrower’s ability to repay.

Bank Statement provides a detailed view of all the transactions undertaken by the Account Holder including deposits, withdrawals, utility bill payments, investments, credit card dues, loan installment payment, debit card payments, interest earned, bank service fees, and more. It gives a perspective into the loan applicant’s preferred transaction channel, viz, Net Banking, Mobile Banking, ATM, Cheque, Cash, Autopay, etc. Any occurrence of Cheque Bounce, Late Payment Charges, Balance Non-Maintenance Charges, etc in bank statements reflects the financial stress in the account. All these attributes are derived from the bank statement to assess the creditworthiness of the borrower and they form an integral part of Credit Analysis.

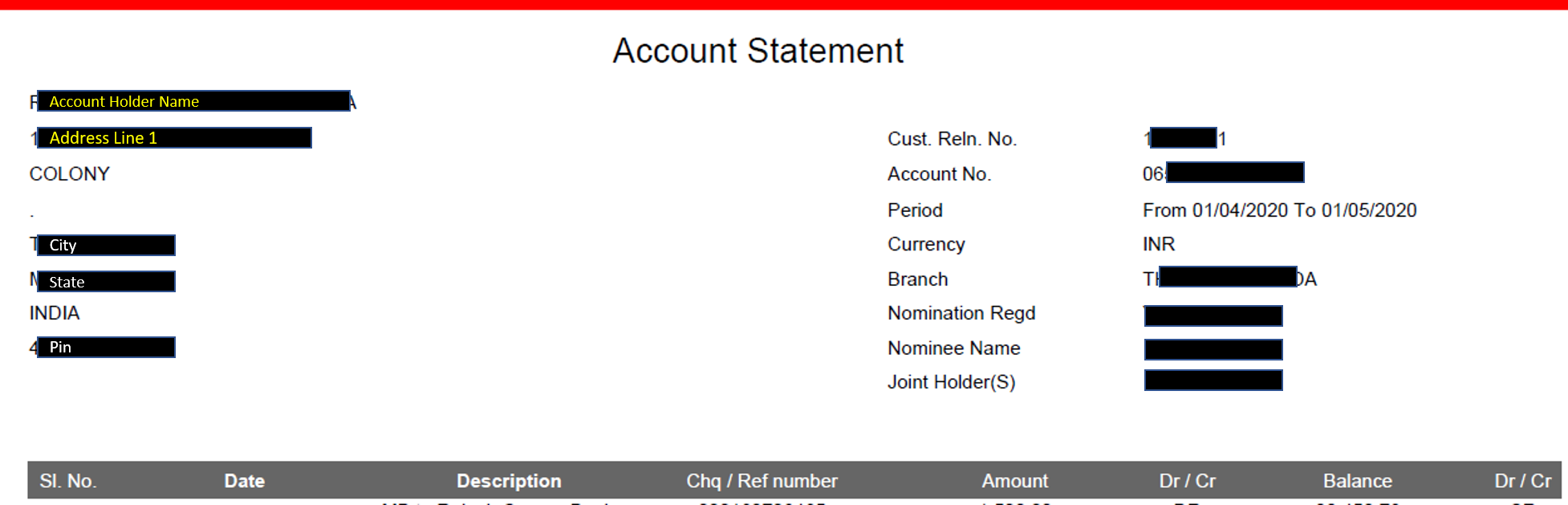

Shown below is the indicative format of a bank statement.

| Date | Particulars / Narration | Ref No | Dr/Cr | Deposits | Withdrawals | Balance |

Creditworthiness Evaluation from Bank Statement Analysis

Bank statement analysis is a quick way to evaluate borrower’s creditworthiness. Traditionally, in the absence of automation, a Credit Officer did the bank statement analysis. She would manually parse the bank statement, eyeballing for keywords like “SALARY”, “SAL”, “CHEQUE BOUNCE”, “NMC CHARGES”, etc in the narration, and tick those transactions. She would then create attributes like:

Salary: See regular salary credit in the statement to arrive at the income of the salaried-individual.

Turnover: The turnover is computed by taking the sum of all deposits in the account other than Interest Credits, Dividends, Reversals, etc which are not business-related credits. A percentage of turnover is assumed to be the income of self-employed/businessmen. It is then correlated with the Income-Tax Return statement.

Average Balance: It is the average of the daily end-of-day balance taken over the selected time period. The manual exercise of computing the average balance from the PDF bank statement is a cumbersome and time-consuming process. As such, for sake of simplicity, some banks took the average of 1st, 5th, 15th, and 30th day end-of-day-balance as average balance.

Regularity of Inflows: Is there regular inflow in the account every month? Yes/No.

Cheque Bounce: Are there any cheque bounces? If yes, how many and were those bounced cheques subsequently paid-off?

Existing Loans: Are there any existing loans going on. If yes, the monthly EMI (Equated Monthly Installment)

Fixed Obligation: How much is the monthly fixed obligations of the customers? It includes all payments like rent, existing loan EMI, monthly utility bill payments like mobile, electricity, gas, and the basic cost of livelihood.

Financial Savvy: Is the person financially savvy? Does he have insurance? Any regular mutual fund investments, PPF, or any other tax-saving instrument under section 80C.

Automated Bank Statement Analysis

The manual process of transcribing data from PDF to excel, eyeballing the statement, scanning for keywords, and performing monotonous mathematical calculations on Excel/Calculator is time-consuming and prone to error. The challenge increases manifold if the bank statement is provided in a scanned image format as we cannot even do copy-paste of data from Image to Excel.

Many Banks & NBFC, realizing this challenge has developed their automated solutions or tied up with technology companies to build parsers to read the bank statement. There are many PDF Reader and OCR Reader solutions available in the market which can read data from PDF and Image respectively.

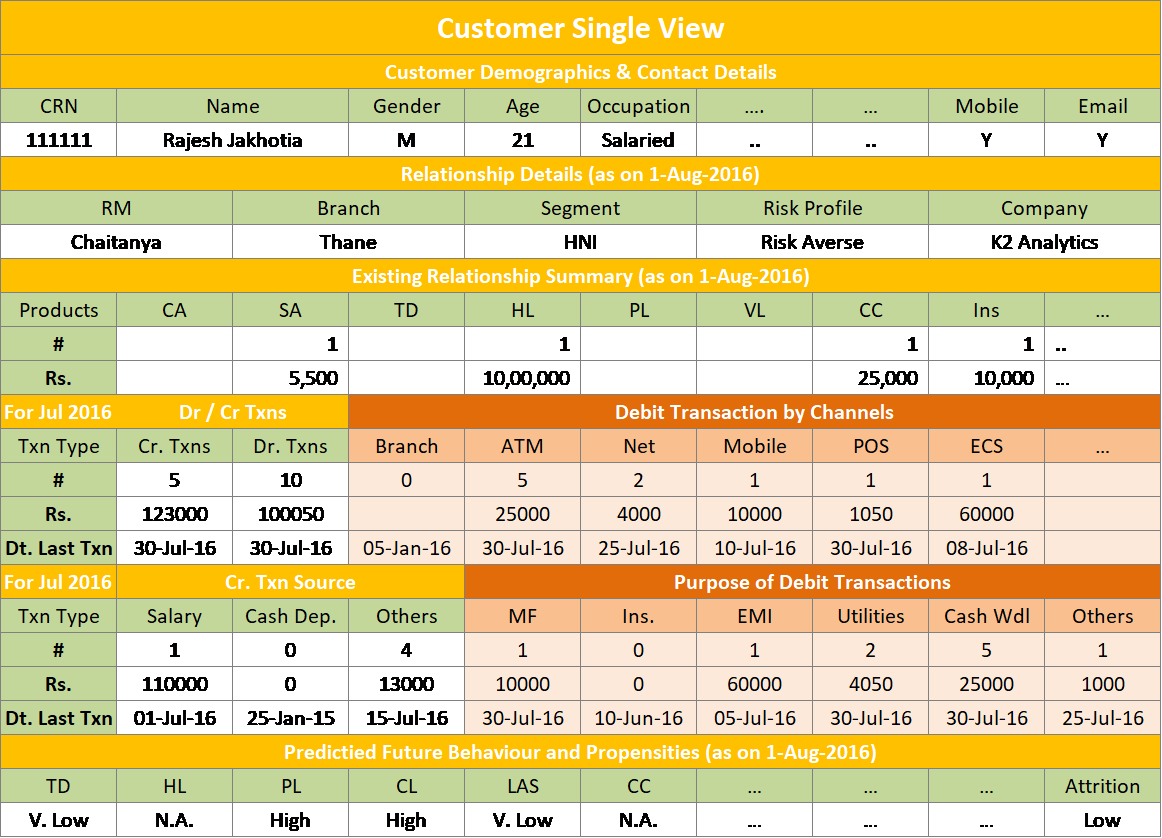

On a detailed automated parsing (analysis) of the bank statement, we can build a 360-degree view of the customer. Shown below is an indicative Customer Single View (360-degree view).

Credit Scoring

The next step in automated credit analysis is to compute the Credit Score using a machine learning model. The credit score is an indicator of the creditworthiness of the customer. Logistic Regression machine learning technique is the most used technique by Banks & NBFCs to build Credit Scorecards.

Thank you

We hope you enjoyed reading this article. Recommend reading for you:

1. How to design a Customer Single View?

2. Advanced Analytics Use Cases in Banking

Is there a software readily available for bank statement analysis? Please provide me.

I want to use for myself.

We wish to avail the BSA services for our loan platform.